Credit Rating Advisory

Comprehensive financial solutions tailored to your business needs

Our Service Offerings

At AK Capital Advisors, we help companies navigate the complex process of obtaining a credit rating, enhancing their credibility, and optimizing their financing options.

What is a Credit Rating?

What is a Credit Rating?

Registration Services

- A credit rating is an independent opinion provided by a rating agency regarding the relative ability and willingness of a debt issuer to meet its financial obligations on time. It assesses the credit quality of an issuer, indicating the probability of timely repayment or potential default.

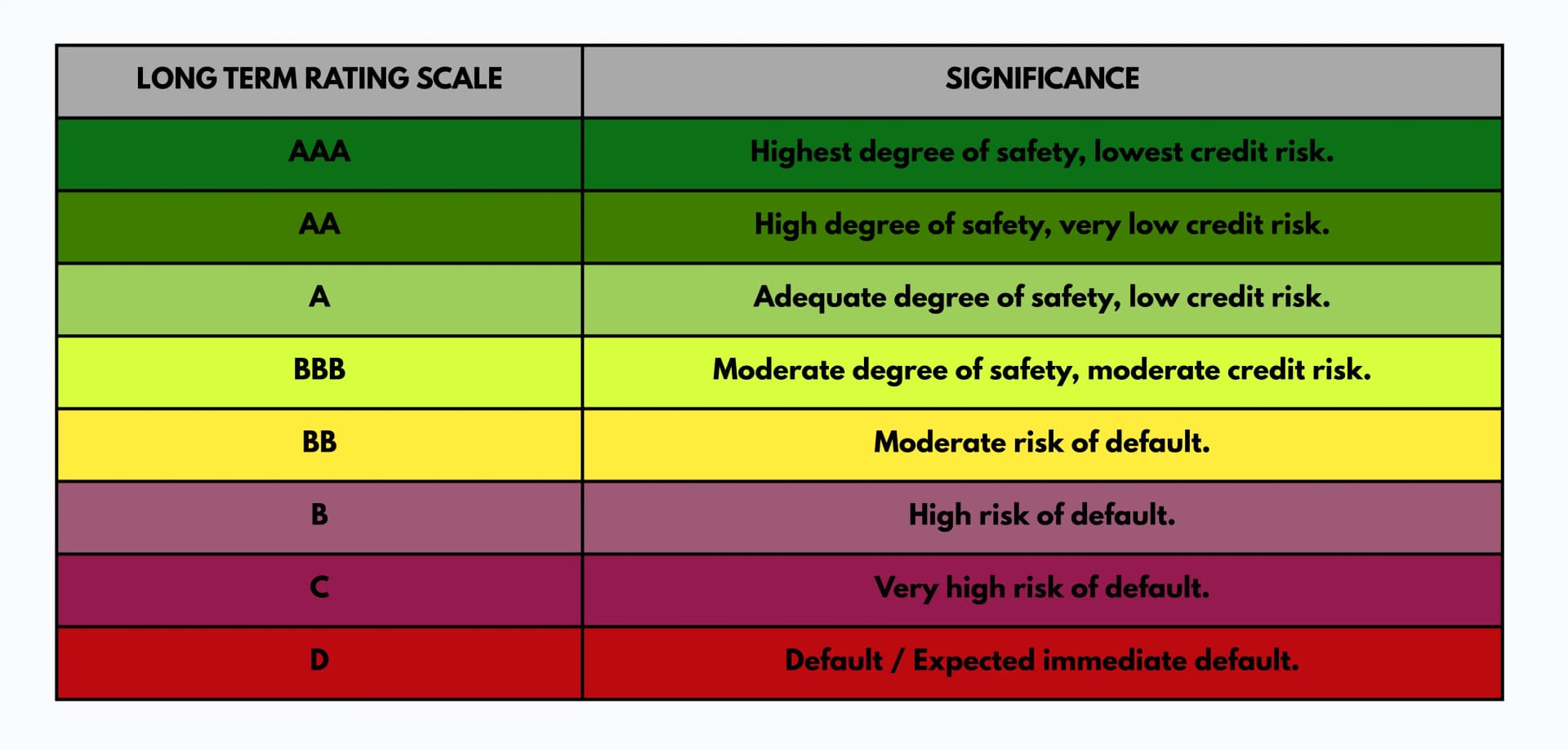

- Credit ratings are expressed using letters that reflect risk:

- ‘AAA’ – Highest rating, lowest risk

- ‘D’ – Lowest rating, highest risk

- A good credit rating allows companies to borrow funds more easily at favorable terms, while a poor rating may lead to higher interest rates or even rejection of loan applications

Why Credit Rating Matters

Why Credit Rating Matters

A company’s credit rating plays a crucial role in shaping its financial strategy, market image, and growth prospects:

- Builds Trust with Lenders – A strong credit rating demonstrates financial discipline, making banks and financial institutions more confident to provide loans and credit facilities.

- Reduces Cost of Borrowing – Companies with higher ratings are viewed as lower risk, allowing them to access funds at more favorable interest rates. Conversely, lower ratings may increase borrowing costs due to perceived higher risk.

- Expands Access to Capital – Well-rated companies attract a wider network of potential lenders, including banks, institutional investors, and capital markets, simplifying the process of raising funds.

- Enhances Financial Flexibility – With a recognized credit rating, companies can negotiate better terms, extend their financing options, and manage cash flow more efficiently.

- Strengthens Market Reputation – A solid credit rating signals reliability and stability to stakeholders, including customers, partners, and investors, helping enhance the company’s overall brand image.

Credit Rating Process Flow

Credit Rating Process Flow

Step-by-Step Process

Our Role at AK Capital Advisors

Our Role at AK Capital Advisors

We are a leading credit rating consulting and advisory firm, providing end-to-end support to corporates seeking to obtain or improve their credit ratings. Our services include:

- Acting as a facilitator between the issuer and rating agency

- Providing detailed analytical support and guidance

- Ensuring efficient completion of the credit rating process

- Advising companies on strategies to enhance creditworthiness

- With our expertise, your company can unlock better financing opportunities, lower borrowing costs, and build a stronger market image.

Ready to get started?

Contact our experts today to discuss how our financial solutions can help your business thrive.